About Us

Status of initiatives for customer-oriented business operations

To further improve our business operations, we review our Customer-Oriented Business Operation Policy at least once a year and also announce the status of our efforts once a year on our website and such.

Initiatives in pursuit of the best interests of customers

To provide high-quality, customer-oriented services and to ensure the best interests of our clients, we encourage our executives and employees to acquire professional qualifications such as ARES* Certified Master and Real Estate Notary to enhance their advanced professional skills and ethics.

*ARES = The Association for Real Estate Securitization

Number of license holders (as of January 1, 2025)

| Qualification | Number of holders | Proportion of executives and regular employees |

|---|---|---|

| Real Estate Securitization Master | 30 | 55% |

| Real Estate Notary | 41 | 75% |

| Real Estate Appraiser | 1 | 2% |

| Certified Building Administrator | 7 | 13% |

Calculations exclude part-time directors and temporary employees.

Initiatives concerning appropriate management of conflicts of interest

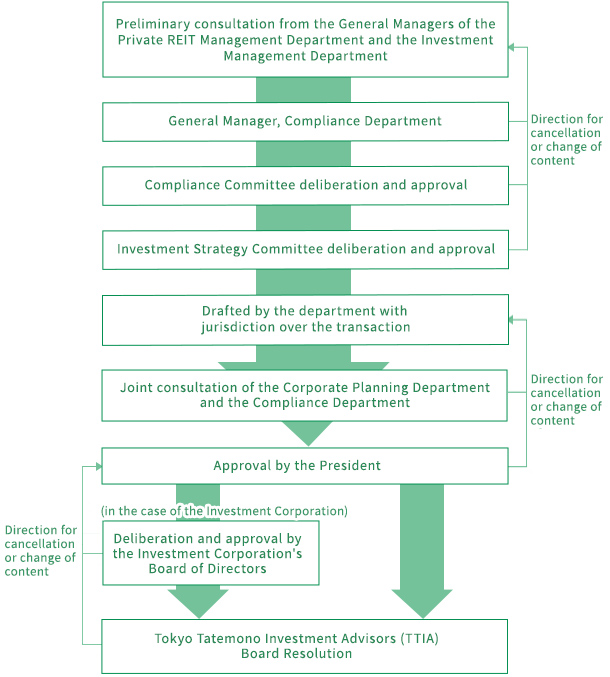

In the event that a client or a related party1 intends to engage in an activity that may cause a conflict of interest2 in our business, we will discuss the details of the transaction as indicated in the diagram below.

| 2022 | 2023 | 2024 | ||

|---|---|---|---|---|

| Number of Compliance Committee meetings | 14 | 14 | 13 | |

| Related-party transactions proposed | 7 | 4 | 8 | |

※1 The following are regarded as related parties:

a) A person who falls under the category of a related party, etc. of the Asset Management Company pursuant to Article 201, Paragraph 1 of the Act on Investment Trusts and Investment Corporations (“Investment Trusts Act”)

b)Shareholders of the Company

c)A corporation whose management is substantially controlled by the Company or its shareholders

d)Clients of the Company's shareholders or related parties as defined in c) to whom the Company's shareholders or related parties as defined in c) are entrusted with investment advisory or investment management services

e)SPCs (limited liability companies, special purpose companies, etc.) in which the Company, its shareholders, or the related parties as defined in c) account for a majority of the investment in the silent partnership, etc.

※2 Asset acquisitions, transfers, or leasing, real estate management outsourcing, brokerage outsourcing for sales and leasing, and construction orders, etc. The following items, however, do not require deliberation by the Compliance Committee.

a)The amount of money (including, but not limited to, sales price, rent, and consignment fees) received by the related party arising from said transaction is less than \5 million (in the case of an ongoing transaction, the amount is determined by the amount per transaction period).

b)Leasing to related parties where the total rent per transaction period of the leased residential property is less than \5 million (new lease, contract renewal [excluding renewal under an automatic renewal clause], or rent revision, etc.)

c)Exercise of rights and performance of obligations based on resolutions by the Compliance Committee

d)Extension of transaction period, etc., in accordance with automatic renewal clauses

Initiatives concerning clarification of fees

Fees borne directly or indirectly by the client basically comprise fees received from the investment corporation or SPC at the time of acquisition, during the term, and at the time of sale. The Company will make every effort to clarify and carefully explain all other costs and expenses in the contract and the product description.

Initiatives concerning the provision important information in an easy-to-understand manner

Private REIT

Tokyo Tatemono Private REIT, Inc. ("TPR") unitholders can access the following dedicated website with a password for each unitholder, and can confirm the scheme as well as return, loss, and other risks, and management status such as conflict-of-interest transactions. TPR unitholders are limited to qualified institutional investors and information is disclosed on the website to meet their requirements.

https://ttp-reit.com/

Other products such as private funds

This product is managed for specified investors including qualified institutional investors. Since the attributes of customers vary, we explain important information such as schemes, returns, risks, trading conditions, and investment status using easy-to-understand expressions, charts, and other means to facilitate understanding while ascertaining customers' needs and status.

Initiatives concerning the provision of services appropriate to customers

Private REIT

This product is limited to qualified institutional investors only, and is intended to provide products that aim to secure stable medium- to long-term income and steady growth of assets under management by investing in real estate or real estate trust beneficiary interests as part of a diversified portfolio as a client's investment vehicle.

Other products such as private funds

This product is designed to invest in real estate or trust beneficiary interests in real estate for specified investors including qualified institutional investors. With the aim of providing suitable products to our clients as part of their diverse investment options, we strive to offer optimal products and services in line with our clients' knowledge, experience, financial situation, and transaction objectives through conversations with our clients at the start of the investment process.

*Under Paragraph 1 of the Financial Instruments and Exchange Act, we are not permitted to sell securities (such as private REIT investment units and preferred equity securities in special purpose companies of private funds). To the extent permitted by industry law, we sell financial instruments (such as silent partnership investments) related to private funds that we have created to our customers, but we may also consider handling financial instruments (such as silent partnership investments) created by other companies.

Initiatives concerning framework for appropriate motivation of employees

In addition to holding cross-departmental study sessions to share know-how for the purpose of providing asset management services with a high level of customer satisfaction, the Company also encourages employees to participate in compliance and other training programs and outside training sessions sponsored by ARES and other organizations on an ongoing basis, thereby instilling in them an awareness of customer-oriented business operations.

Moreover, one of the items in the personnel evaluation is their attitude toward providing asset management services with a high level of customer satisfaction and compliance.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Number of in-house training sessions | 10 | 13 | 11 |

In addition to the above, we conduct cross-departmental study sessions and compliance and other training for new employees.